Small Business Improvement Fund (SBIF)

Launched in 1999, the City of Chicago’s Small Business Improvement Fund (SBIF) promotes economic development by providing small businesses and property owners with reimbursement grants for permanent building improvement costs. Residential projects are not eligible.

The SBIF grant is funded by local Tax Increment Financing (TIF) revenue and is made available to business and property owners located in the SBIF-eligible TIF districts citywide. Grant funds may be used to reimburse up to 90% of pre-approved construction costs, with a maximum reimbursement of $75,000 for multi-tenant properties, $150,000 for commercial properties, and $250,000 for industrial properties.

SomerCor is proud to administer the SBIF Grant on behalf of the Chicago Department of Planning and Development.

Already applied? Find more resources on the Current Applicants page.

Grant Amount

The maximum grant amount and reimbursement percentage is determined by the property and business type.

Commercial

Commercial business and property owners may receive a maximum of $150,000 in reimbursement. The percentage of reimbursement is determined by the business's gross sales and/or the property owner's net worth:

| Gross Sales or Net Worth | Percent Reimbursed |

|---|---|

| $0 - $3 Million | 90% |

| $3 - $ 6 Million | 60% |

| $6 - $9 Million | 30% |

Industrial

Industrial businesses and properties may receive a maximum of $250,000 in reimbursement.

All industrial projects are eligible for 50% reimbursement of costs.

Property owners that lease more than 50% of the property to one or more entities in which they do not have an ownership interest are to be evaluated for eligibility under the Net Worth and Liquidity Requirements.

Eligibility

Eligible Applicants

-

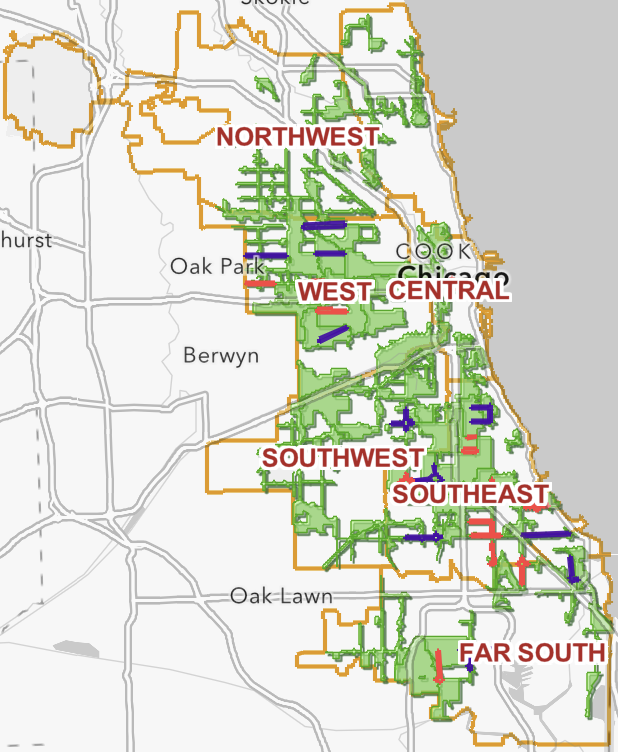

The project property must be located within a SBIF-eligible TIF district. Verify if your property is in a TIF with the SBIF Locator Tool.

-

Commercial businesses with an average of less than $9 million in annual gross sales.

-

Industrial businesses with no more than 200 full-time employees.

-

Property owners with a cumulative net worth of less than $9 million and less than $500,000 in liquid assets.

-

Must have site control of property in the form of a deed or executed lease agreement with the title-holder.

Ineligible Applicants

| national chains | liquor stores | gas stations |

| employment agencies | hotels and motels | places of worship |

| currency exchanges | adult uses | smoke shops/cigar lounges |

| loan stores | private clubs | tobacco dealers |

| pawn shops | wagering facilities | storage warehouses |

| fortune telling service | K-12 schools | start-up bars/taverns |

| branch banks | firearms dealers | start-up banquet halls |

These lists are not comprehensive. Please contact SomerCor with any questions about eligibility.

Eligible Expenses

All expenses must be approved by the City of Chicago before construction starts and prior to any payments to contractors. Permanent building improvements that enhance the appearance or viability of a property are generally eligible for reimbursement. Eligible improvements may include, but are not limited to:

-

roof and façade improvements

-

alterations or structures needed for ADA compliance (e.g., railings or ramps)

-

HVAC and other mechanical systems

-

plumbing and electrical work

-

permanent interior renovations, including fixtures

-

solar panels

Ineligible Expenses

The following items are not eligible for reimbursement. This list is not comprehensive.

-

work on the interior of residential units

-

new construction (additions/expansions, “ground up”)

-

stand-alone minor repairs or cosmetic improvements

-

equipment-related expenses (e.g. kitchen appliances, computers, office furniture)

-

planters surrounding or affixed to buildings

-

outdoor dining or drinking areas

-

fencing including pergolas, trellises, arbors, privacy screens, and similar structures

-

parking lot construction or repair

-

landscaping

-

business-specific items

For full eligibility and requirements, please see the SBIF Program Rules.

TIF Rollout Calendar

SBIF applications must be submitted during monthly rollout periods for individual TIF districts. Upcoming dates are listed below. Applications received for a TIF district outside of its open acceptance period will be rejected.

Current TIF Districts

Check your TIF district with the SBIF Locator Tool. Ready to apply?

May 2025

OPENS: May 1 at 9:00 A.M.

CLOSES: May 30 at 5:00 P.M.

Informational Webinar:

May 7 (Wed) at 1:00 P.M. Video

Upcoming TIF Districts

June 2025

OPENS: June 1 at 9:00 A.M.

CLOSES: June 30 at 5:00 P.M.

Informational Webinar:

June 4 (Wed) at 1:00 P.M. Register

July 2025

OPENS: July 1 at 9:00 A.M.

CLOSES: July 30 at 5:00 P.M.

Informational Webinar:

July 2 (Wed) at 1:00 P.M. Register

August 2025

OPENS: August 1 at 9:00 A.M.

CLOSES: August 30 at 5:00 P.M.

Informational Webinar:

August 6 (Wed) at 1:00 P.M. Register

September 2025

OPENS: September 1 at 9:00 A.M.

CLOSES: September 30 at 5:00 P.M.

Informational Webinar:

September 3 (Wed) at 1:00 P.M. Register

October 2025

OPENS: October 1 at 9:00 A.M.

CLOSES: October 30 at 5:00 P.M.

Informational Webinar:

October 1 (Wed) at 1:00 P.M. Register

November 2025

OPENS: November 1 at 9:00 A.M.

CLOSES: November 30 at 5:00 P.M.

Informational Webinar:

November 5 (Wed) at 1:00 P.M. Register

December 2025

OPENS: December 1 at 9:00 A.M.

CLOSES: December 30 at 5:00 P.M.

Informational Webinar:

December 3 (Wed) at 1:00 P.M. Register

SBIF Application

To apply for the SBIF program, please download and fill out the application. Once complete, email the application to [email protected] during your TIF open acceptance period.

After submitting your application, you will receive a confirmation email within two business days to confirm the application was received and advise of any preliminary concerns. If you do not receive an email confirmation within this time, please reach out to verify your application status.

Applicants are responsible for making sure submissions are received within the open acceptance period. Applications received after 5 P.M. on the last day of the acceptance period will not be eligible.

If a lottery is not needed, a SBIF Project Coordinator will reach out to to begin Stage 1 a few weeks after the application period has closed.

SBIF Program Timeline

Applicants who do not complete each stage in the required time limit will be disqualified and removed from the program.

SBIF Estimate Calculator

This interactive tool can provide an estimated SBIF grant amount based on the information entered.

IMPORTANT: This is for informational purposes only. Several factors can affect eligibility and final grant amount. All costs must be approved prior to construction.