SBA 504 Loans for Small Businesses

SomerCor provides SBA 504 loans to small and mid-size business owners as an affordable option to fund commercial real estate and heavy equipment purchases. The program offers low down payments, below-market, long-term, fixed-rate financing, and lots of other benefits to support businesses in growth mode. Contact a member of SomerCor to learn more today!

Already have an SBA 504 loan with SomerCor? Find more resources on the Current Borrowers page.

SBA 504 Loan Basics

What is an SBA 504 loan?

The SBA 504 loan is a business financing option provided by the U.S. Small Business Administration (SBA) through Certified Development Companies (CDCs) like SomerCor. These loans are designed to help businesses grow and create jobs by financing the purchase, improvement, or refinance of owner-occupied commercial real estate and fixed equipment.

The name of the program comes from Section 504 of the Small Business Investment Act of 1958. The current structure of the 504 program has been in place since 1986.

The program was created as a response to concerns that small businesses might be prevented from accessing sufficient capital to enable them to create and retain jobs.

The 504 program is the SBA’s premier economic development program and has public policy requirements that support:

- Job Creation/Retention

- Community Development

- Minority (MBE), Women (WBE), and Veteran-Owned Businesses

- Energy Efficiency

The SBA 504 Loan Advantage

The benefits to the borrower include:

Lower down payment – up to 90% financing for established businesses

Below-market interest rates – lower and more affordable monthly mortgage payments

Long term fixed rates 10, 20 or 25 year – no surprise balloon payments

Frees up working capital – more money to reinvest in the business

SBA 504 Loan Uses

What can an SBA 504 loan be used for?

Eligible Expenses

Purchase commercial real estate

Purchase one or more existing buildings

Convert, expand or renovate one or more existing buildings

Acquire and install machinery and equipment having a useful life of ten years or more. These assets must be at a fixed location.

Construction of real estate

Refinance mortgage debt, including certain existing SBA 7(a) and 504 loans, through the 504 Refi Program

Cover certain soft costs and professional fees

Ineligible Expenses

Residential projects

Working Capital

Inventory

Goodwill

Business Stock

Vehicles

Franchise fees

Legal Fees

These lists are not comprehensive. Please contact SomerCor with any questions about eligibility.

Who Can Apply

What type of business is eligible for an SBA 504 loan program?

To apply for the 504 loan an applicant must:

- Be a for-profit business, located in the United States

- Have a tangible net worth less than $20 million

- Average net income, after federal income taxes, of less than $6.5 million for the preceding two years (note – industry parameters may apply)

The 504 loan is available to a broad range of entrepreneurs and industries. Manufacturing, health care, professional services, restaurants, franchises, fitness/recreation, retail, childcare, construction/trades, entertainment, breweries, and storage/warehouse, – all these industries and more can utilize the 504 program.

Contact our team to learn more at (312) 360-3300 or info@somercor.com.

How Does It Work

The SBA 504 program requires three key players – a small business borrower, a CDC, and a third-party lender (i.e. bank, credit union, or private lender). CDCs, like SomerCor, are non-profit companies, certified and regulated by the SBA, to originate and service SBA 504 loans.

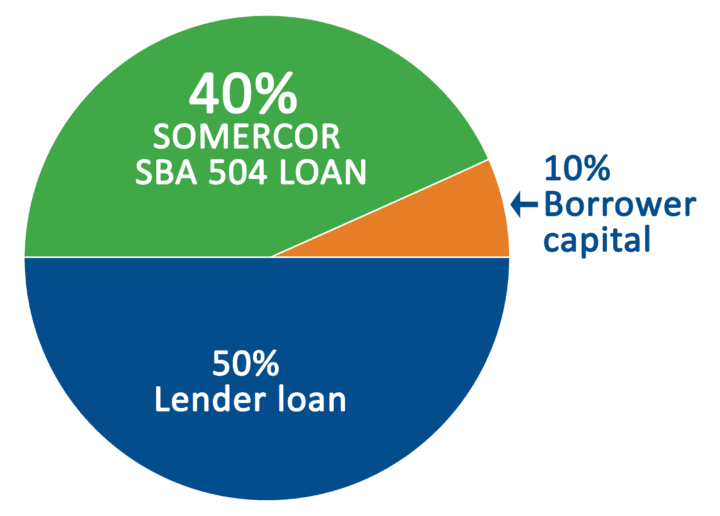

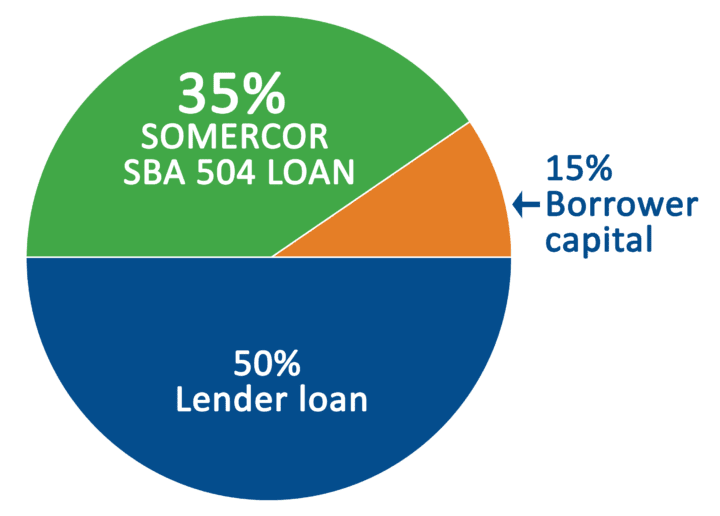

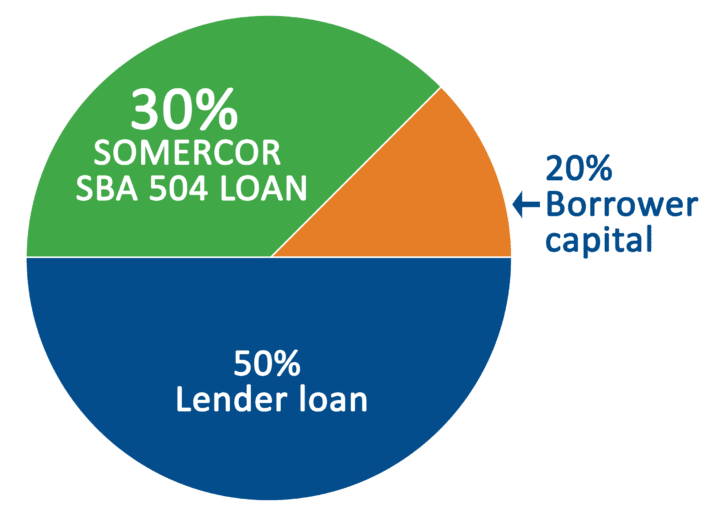

Typically, the final loan structure requires the third-party lender to provide 50% of the financing, the CDC provides up to 40% of the financing backed by a 100% SBA-guaranteed debenture, and the applicant provides at least 10% of the financing.

Existing business, multi-use building

New business or single-use building

Both new business and single-use building

How Does It Compare

| SBA 504 Loan | SBA 7(a) Loan | Conventional Loan | |

|---|---|---|---|

| Loan Amount | Total Project: No maximum SBA 504 loan: Up to $5 million up to $5.5 million for manufacturing and green (energy efficient) loan projects (per project with no cap on the aggregate amount to borrow) | Up to $5 million | Varies by lender |

| Eligibility | Businesses must operate for profit, have a net worth less than $20 million, and meet net income requirements | Businesses must operate for profit, operate in the U.S., have owner equity to invest, and exhaust other financial resources before applying | Varies by lender |

| Uses | Purchase, construction, or improvement of buildings, land, new facilities, and machinery and equipment | Working capital, real estate, equipment, construction, establishing a new business, inventory, and refinancing business debt | Varies by lender |

| Terms | 10-, 20-, and 25-year terms | 10 years for a working capital or inventory loan, 10 years for an equipment loan, and 25 years for a real estate loan | 5-10 Years (typically) |

| Interest Rates | Fixed rate, determined monthly, traditionally below-market rate - reflective of 10 year Treasury view current rate here | Varies by use and amount

Maximum Rates: <$25,000 is Prime +8% $25,001-$50,000 is Prime +7% $50,001-$250,000 is Prime +6% >$250,000 is Prime +5% Negotiated by borrowers and lenders, not to exceed the SBA’s maximums | Varies by lender |

| Down Payment | 10% | 10% | 25% |

| Collateral | Project assets being financed by the loan serve as collateral. | Required for loans of $25,000 and up | Varies by lender |

| Structure | 50% lender 40% SBA (via SomerCor) 10% Borrower | 90% lender 10% borrower | 75% Lender 25% borrower |

How To Apply

We are here to help. Get started by filling out this form. One of our team members will follow up with you.

Key items borrowers should have prepared include:

- Last three years corporate tax returns for business & personal federal income tax returns

- Last three years corporate tax returns for all affiliates (if any)

- Interim financial statements (within 90 days)

- Schedule of existing company debt (creditor, balance, monthly payment)

- Most recent aging of accounts receivable and payable

- Two-year income and expense projections

- Borrower’s personal financial statement (bank form is acceptable)

What Factors Determine Loan Approval?

The goal of the SBA and SomerCor is to help small businesses access capital. A potential deal is reviewed by SomerCor, the third-party lender, and the SBA. Overall, the loan must be sound so as to reasonably assure repayment. The SBA will consider:

- borrower character, reputation, and credit history

- experience and depth of management

- market demand for the borrower’s product or service

- past earnings, projected cash flow, and future projections

- ability to repay the loan with earnings from the business

- sufficient invested equity to operate on a sound financial basis

- potential for long-term success

- nature and value of collateral (although inadequate collateral will not be the sole reason for denial of a loan request)

What Are Best Practices For Applying For The SBA 504 Loan Program?

Know your numbers and your need: When applying for an SBA 504 loan, the first step is to know how much capital is needed and for what purpose. Be able to clearly explain how the funds will be used and how it will benefit the small business. Also, provide a detailed business plan and financial projections that are based in reality to support the loan request.

Provide complete and accurate loan documentation: One of the top reasons loans stall in the application process is because of incomplete or inaccurate documentation. The more quickly a borrower provides the required documents, the faster a project will progress toward funding.

Be up front with your CDC and business lender: Both the CDC and third-party lender will be reviewing financial documents and underwriting the loan. If there are any negative elements that may impact creditworthiness, such as bankruptcy or pending litigation, be forthright with that information. This allows an opportunity for the underwriters to learn about the business and provide guidance that may mitigate weaknesses.

What's The Process

After applying for the SBA 504 loan program, the approval and funding process includes the following:

Apply For An SBA 504 Loan

Talk to a SomerCor Loan Officer

Complete the START HERE form with details about your project and a member of the SomerCor team will be in touch or call us at (312) 360-3300 or contact one of our loan officers today!