Partner with SomerCor on SBA 504 Loans

SomerCor partners with banks, credit unions, and other private lenders to provide SBA 504 loans to small and mid-size business owners as an affordable option to fund commercial real estate and heavy equipment purchases. The SBA 504 loan program helps our lending partners expand their small business lending portfolio and increase investment in their local communities.

Contact a member of SomerCor to learn more today!

Does your client already have an SBA 504 loan with SomerCor? Find more resources on the Current Borrowers page.

SBA 504 Loan Basics

What is the SBA 504 loan program?

The SBA 504 loan program is the premier economic development loan program administered by the Small Business Administration (SBA). This public-private partnership provides a long-term fixed rate lending solution for small and mid-size businesses to buy, build, expand major fixed assets – such as land, commercial real estate, equipment, and machinery. The program name comes from Section 504 of the Small Business Investment Act of 1958.

Additionally, the SBA 504 program has a refinance option, made permanent in 2016. Businesses can use the SBA 504 refi to leverage built-up equity and take money out for eligible operating expenses.

Structure of the SBA 504 Loan

The SBA 504 program requires three key players – a small business borrower, a CDC, and a third-party lender (bank, credit union, or private lender). CDCs, like SomerCor, are non-profit corporations, certified and regulated by the SBA, to originate and service SBA 504 loans.

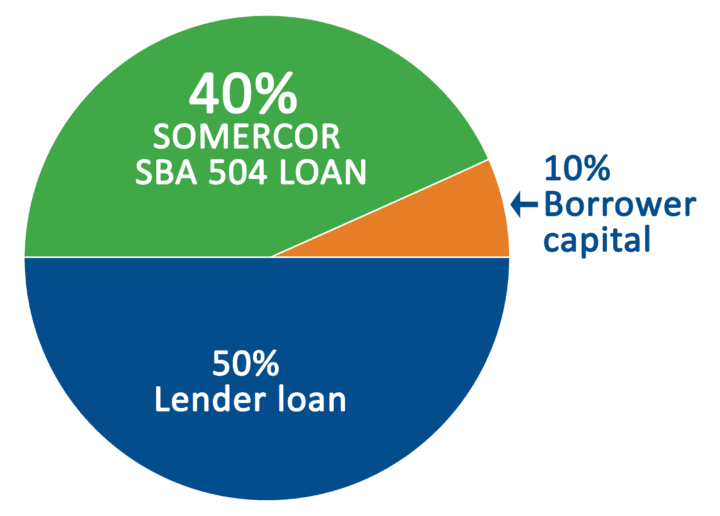

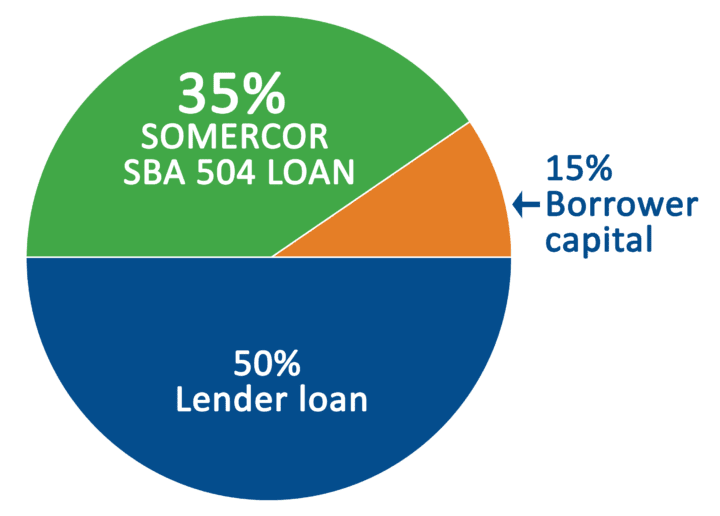

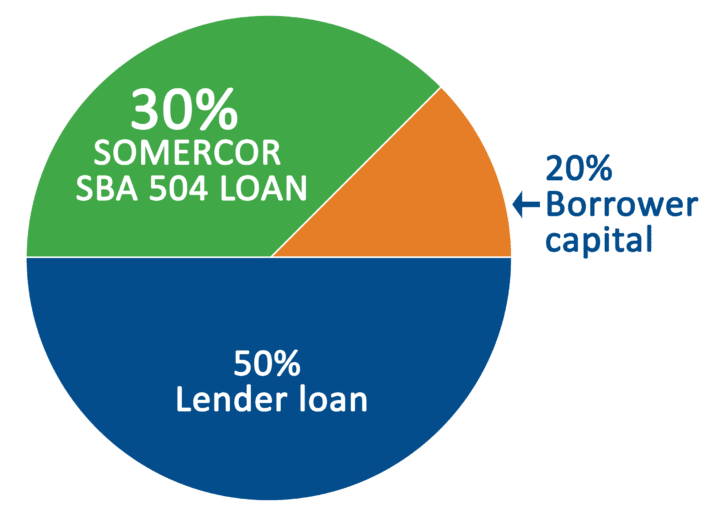

Typically, the final loan structure requires the third-party lender, to provide 50% of the financing, the CDC provides up to 40% of the financing backed by a 100% SBA-guaranteed debenture, and the applicant provides at least 10% of the financing.

Existing business, multi-use building

New business or single-use building

Both new business and single-use building

Eligible Businesses

What businesses are eligible for the SBA 504 loan?

- For-profit business

- Under $20MM in tangible net worth

- Prior 2 years average after tax net income under $6.5MM

- For commercial real estate, at least 51% applicant occupancy (60% for new construction) is required

- The 504 works for all these industries and more: Manufacturing, health care, warehouse and logistics, restaurants, education & childcare, franchises, hospitality, professional services, retail, senior care facilities

SBA 504 Loan Uses

What can an SBA 504 loan be used for?

Eligible Expenses

Purchase commercial real estate

Purchase one or more existing buildings

Convert, expand or renovate one or more existing buildings

Acquire and install machinery and equipment having a useful life of ten years or more. These assets must be at a fixed location.

Construction of real estate

Refinance mortgage debt, including certain existing SBA 7(a) and 504 loans, through the 504 Refi Program

Cover certain soft costs and professional fees

Ineligible Expenses

| Residential projects |

| Working Capital |

| Inventory |

| Goodwill |

| Business Stock |

| Vehicles |

| Franchise fees |

| Legal Fees |

These lists are not comprehensive. Please contact SomerCor with any questions about eligibility.

SBA 504 Loan Benefits

Benefits and opportunities for lenders using the SBA 504 loan:

Lower Lending Risk

- The loan to value (LTV) ratio for the third-party lender loan will not exceed 50%

- 504 loans are collateralized by real estate or other fixed assets

- The third-party lender loan is in the first lien position and the CDC loan is subordinate to the third-party lender’s position

- The CDC loan is backed by a 100% SBA guaranteed debenture

- The 504 loan program has a strong performance track record, the national charge off rate is .6% over the last 10 years

Expands Credit Box

- The 504 provides credit enhancement to serve customers who otherwise might not qualify

- SBA 504 program helps third-party lenders with lower lending limits to expand their small business lending capacity

- Bank lenders may be eligible for Community Reinvestment Act credit when using 504 loans

Diversify and Strengthen Portfolio

- The 504 is not industry specific providing the opportunity to appeal to clients across a variety of verticals

- For existing customers, the 504 refi is an option to help clients access to equity

- Diversifies portfolio to avoid a concentration of bank specific conventional loans

Increase Liquidity

- Third-party lender typically finances 50% of a 504 project vs 75% of a conventional loan

- Third-party lender can earn fees and interest income on interim/bridge loans related to a 504 project

- Selling 504 first lien loans in the secondary market can help a third-party lender manage its lending limits

- When partnering with a CDC, a non-depository entity, the third-party lender maintains the borrower relationship

Retain & Grow Business Clients

- Provide a full range of financing options with the goal of helping the client and building long term loyalty

- Borrower friendly terms of 504’s fixed long-term finance structure are powerful marketing tools to attract new clients

- Offering a business client an SBA 504 loan, may be the starting point for forming a broader client relationship

- CDCs, like SomerCor, do the heavy lifting with the SBA 504 loan by performing all lending operations; unlike other SBA products, lenders need not have permission from the SBA to provide a 504 loan with a CDC

The benefits to the borrower include:

| Below-Market Interest Rates - Even in a high interest rate environment, the 504 effective interest rate is below-market |

| Payment Predictability - Secure fixed rate financing for up to 25 years with the 504 program |

| Less Money Down - Up to 90% financing for established businesses - freeing up capital that would normally be designated for paying off loans, to instead be reinvested back into growing the business |

| Ownership - Stop paying rent and start building equity; every payment contributes to borrower’s personal wealth, not someone else’s |

| Property Control - Customize the business property, expand as needed, and create a lasting asset for the business’s future growth |

| Unlock Valuable Tax Advantages - Mortgage interest deductions and depreciation benefits |

Program Updates

Here are the latest program updates from the SBA:

Partner with SomerCor

Why should I partner with SomerCor on an SBA 504 loan?

- We are a go to lending partner for banks, credit unions, and private lenders - we have partnered with 335 lending institutions since 1992

- Deep expertise in performing all SBA 504 lending operations in-house including underwriting, SBA submissions, closings, and servicing

- Ranked in the top 15 among CDC’s nationally for 504 origination volume - SomerCor has deployed more than $1.77 billion in SBA loans to 3,807 businesses in 1,740 communities, leading to the creation of 46,637 jobs

- SomerCor is an SBA Accredited Lender Program designated lender for its high performing lending operations and is a Better Business Bureau accredited business with an A+ rating for its ethical business practices

- Service area includes the state of Illinois, Jasper, Lake, Newton, and Porter counties in Indiana, and Rock and Kenosha counties in Wisconsin

- Mission is to grow businesses, create jobs, and increase impactful investment in every community through excellence in SBA 504 lending and outstanding customer service

How do I connect with SomerCor to partner on an SBA 504 loan for a client?

Reach out to a member of our loan origination group with any questions or to request an estimate term sheet. We are also available to meet with you or members of your commercial lending team to present updates on the SBA 504 program.

Call on us - we help our lending partners navigate the SBA 504 lending process quickly and efficiently.