The June 2022 SBA 504 debenture pricing was competed on June 9, 2022.

25 Year Term 5.19%

20 Year Term 5.13%

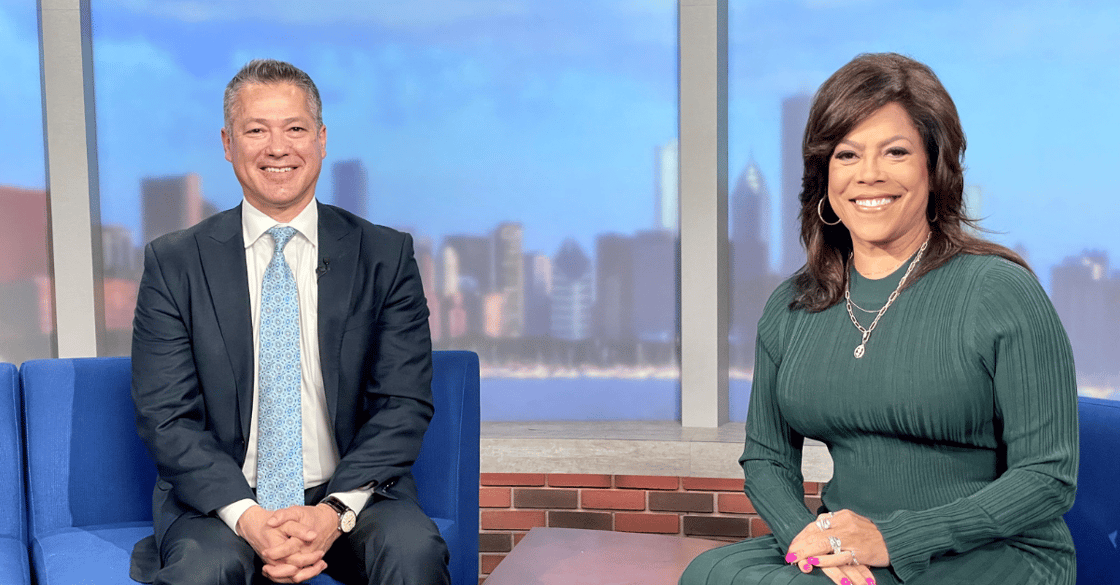

SomerCor is proud to be a presenting sponsor of the World Business Chicago Black and Latino Excellence Investment Summit. This initiative supports access to capital for Black and Latino-owned small businesses on Chicago’s South and West Sides. SomerCor CEO, Manny Flores, was interviewed on WGN’s People to People to promote the program.

SomerCor has partnered with Matt and Andrea Dearwester on three SBA 504 loans. The most recent project was the construction of a new feed processing mill for Nutrition Services, Inc. The location includes a 20-acre parcel of land with a 12,600 square foot industrial building. The SBA 504 loan can be a great fit for agricultural businesses to purchase, expand, and refinance commercial real estate and heavy equipment.