September SBA 504 Interest Rates Cap Record-Breaking FY21

The September 2021 SBA 504 debenture pricing was competed on September 9, 2021.

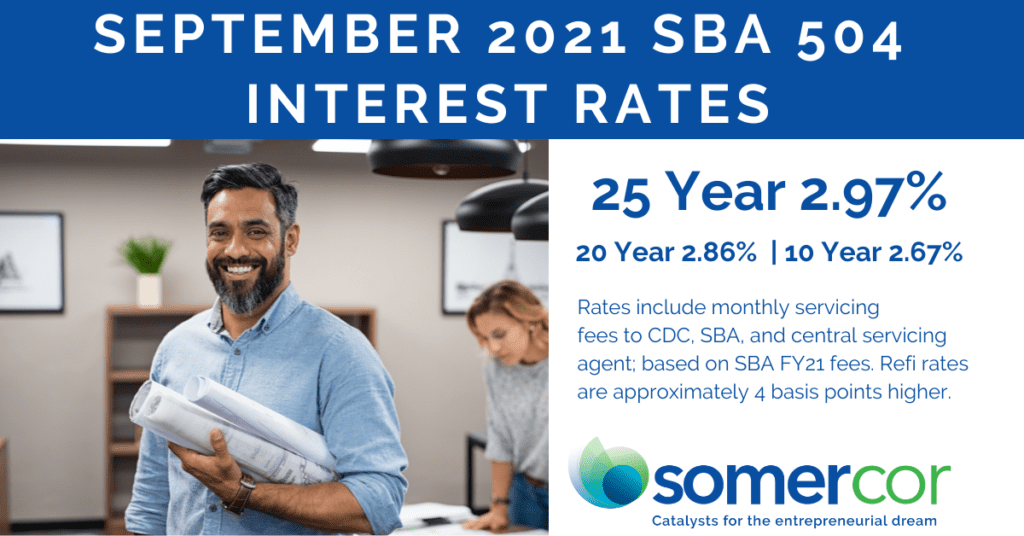

25 Year Term 2.97%

20 Year Term 2.86%

10 Year Term 2.67%

The SBA is offering a 504 Loan with a 25-year maturity for the acquisition of owner-occupied commercial real estate and related costs. This is in addition to the 10 and 20 year loans currently available in the 504 Loan Program. Loans are typically eligible for up to 90% financing of project costs. Rates include monthly servicing fees to CDC, SBA, and central servicing agent; based on SBA FY21 fees. SBA 504 refi rates are approximately 4 basis points higher than debenture pricing noted above.

Update: FY22 SBA 504 Fees

On September 7, 2021, SBA issued SBA Information Notice 5000-818642, announcing the fees for 504 Loans approved during FY2022, including the FY2022 annual service fee (also known as the “ongoing guaranty fee”) and upfront guaranty fee.

SBA 504 Refi Program Expanded

On July 29th, the Small Business Administration published Interim Final Rule 021-15975, outlining enhancements to the SBA 504 REFI program. SomerCor hosted a webinar on these program changes August 11, 2021