June SBA 504 Interest Rates Stay Below 3%

The June 2021 SBA 504 debenture pricing was competed on June 10, 2021.

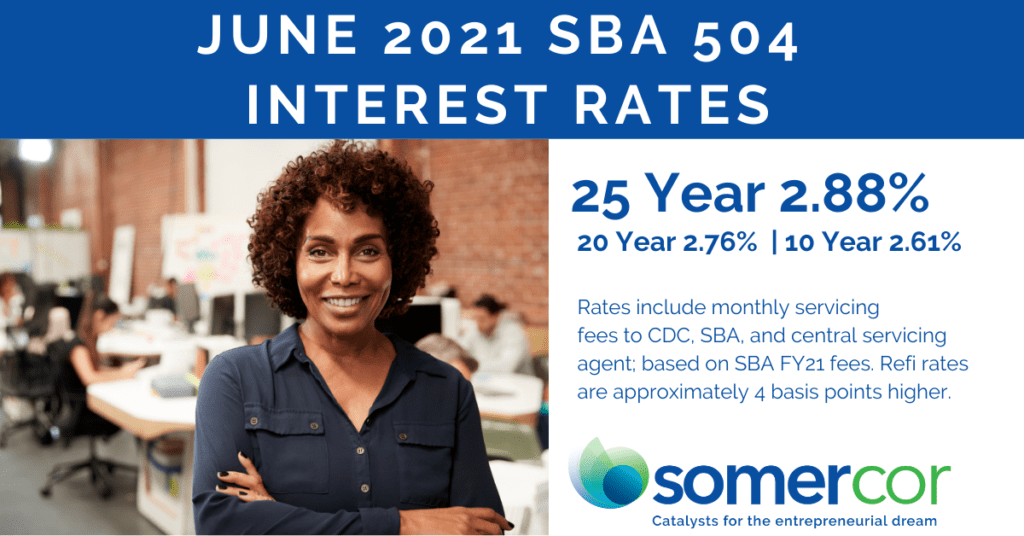

25 Year Term 2.88%

20 Year Term 2.76%

10 Year Term 2.61%

The SBA is offering a 504 Loan with a 25-year maturity for the acquisition of owner-occupied commercial real estate and related costs. This is in addition to the 10 and 20 year loans currently available in the 504 Loan Program. Loans are typically eligible for up to 90% financing of project costs. Rates include monthly servicing fees to CDC, SBA, and central servicing agent; based on SBA FY21 fees. SBA 504 refi rates are approximately 4 basis points higher than debenture pricing noted above

In addition to payment relief and waived fees for loans approved before September 30, 2021, changes to the 504 REFI and the rollout of the 504 Express Loan program are on the horizon.

Pending SBA guidance, Certified Development Companies with Approved Lender Program (ALP) Status, like SomerCor, will have the authority to approve, authorize, close, and service 504 loans of $500,000 or less. Plus, the SBA will allow the refinancing of certain existing government-guaranteed debt.

Click below for the latest information on these initiatives.

We couldn’t pass up the opportunity to lock in a significant portion of our debt for 25 years at a rate below 3%… Plus, SomerCor did a great job partnering with my bank they made the process so easy, letting me focus on operating my business.”

– Josh Fischer, President

Anticipated growth and the desire to streamline operations all under one roof led Fischer Paper Products president, and his business banker to pursue the SBA 504 program. They teamed up with SomerCor to access fixed long-term financing for the ground-up construction of a new headquarters.