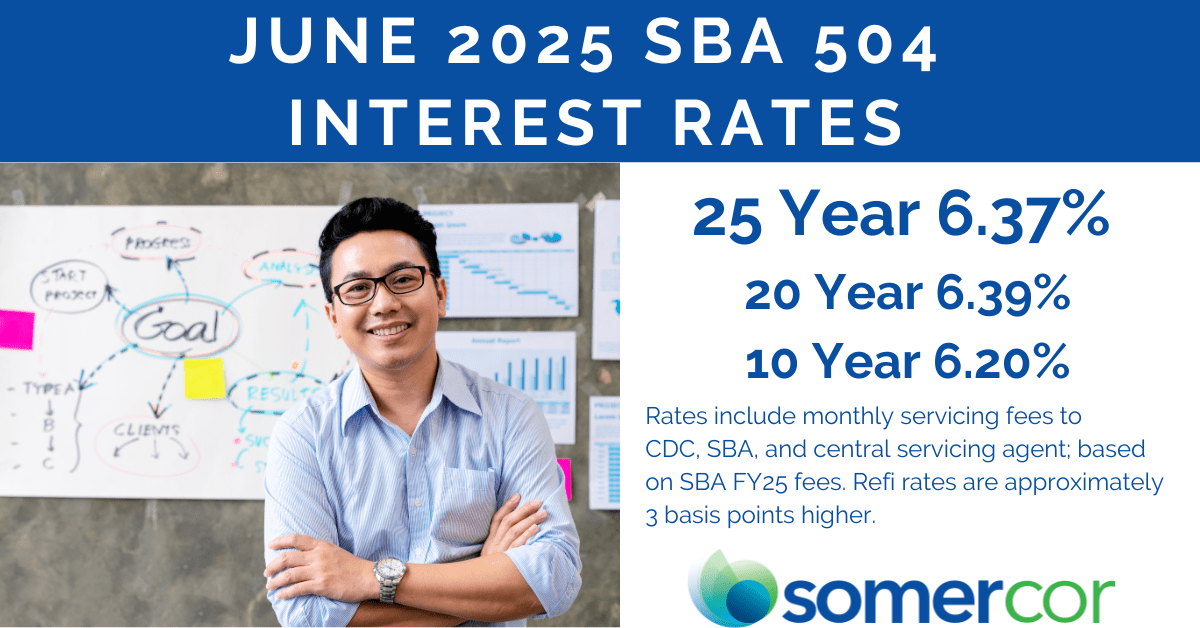

June 2025 SBA 504 Interest Rates

25 Year Term 6.37%

20 Year Term 6.39%

10 Year Term 6.20%

The June 2025 SBA 504 debenture pricing was completed on June 5, 2025. The SBA offers a 504 Loan with a 25-year maturity for the acquisition of owner-occupied commercial real estate and related costs. This is in addition to the 10 and 20 year loans currently available in the 504 Loan Program. Loans are typically eligible for up to 90% financing of project costs. Rates include monthly servicing fees to CDC, SBA, and central servicing agent; based on SBA FY25 fees. SBA 504 refi rates are approximately 3 basis points higher than debenture pricing noted above.

Meeting the capital needs of small businesses requires innovation and collaboration. That’s why SomerCor is proud to lead efforts across the small business ecosystem to increase access to affordable financing through the SBA 504 program and other resources.

Our newest partnership with the Aurora Regional Economic Alliance combines SomerCor’s lending and grant administration expertise with the Alliance’s strong local presence and commitment to inclusive growth. Together, we’re working to empower entrepreneurs and small business owners in the region with the resources and financing they need to succeed.

To learn more, check out this story via the Daily Herald by SomerCor President & CEO, Manny Flores.

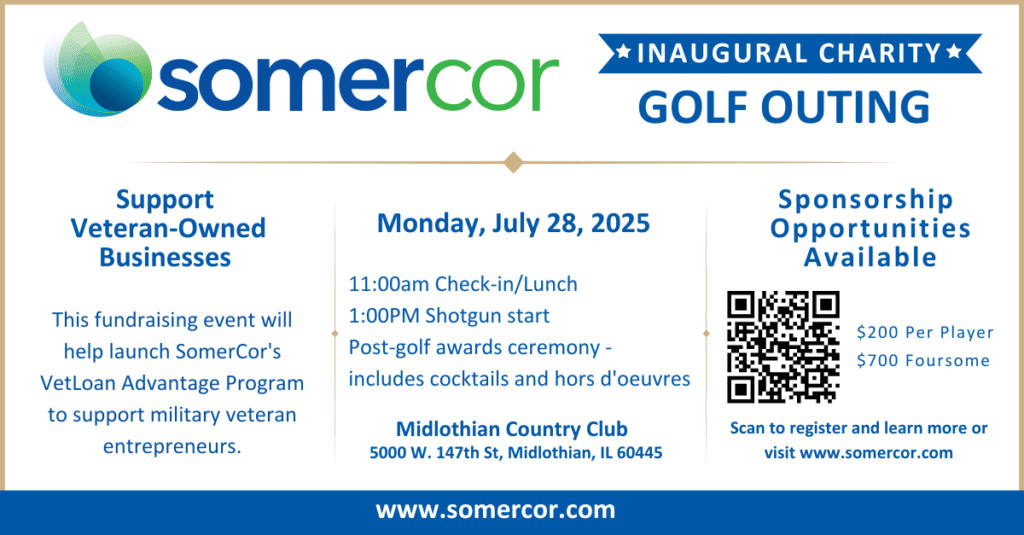

SomerCor Inaugural Charity Golf Outing

SomerCor is hosting its 1st Annual Charitable Golf Outing on July 28, 2025, at the Midlothian Country Club! This inaugural event will bring together commercial lenders, industry leaders, and community stakeholders for a day of golf, networking, and philanthropy.

Sponsorship opportunities are available now. A special thank you to Premier Title, Brown CPA Group, Ltd., Old National Bank, Fifth Third Bank, Wintrust, InBalance, Bespoke Commercial Real Estate, Alera Group, Pichón, and Cornerstone National Bank for their early support!

The outing will mark the launch of SomerCor’s participation in the National Association of Development Company’s (NADCO) VetLoan Advantage Program, a national initiative designed to support military veterans in starting or growing their businesses. Proceeds from the golf outing will be earmarked to support veteran entrepreneurs – helping to fund critical business expenses such as business advisory services, loan fee waivers, and down payment assistance on SBA 504 and Community Advantage Loans.

Scan the QR code above or click the button below to select a sponsorship or sign-up your foursome! Thank you for your support and we look forward to seeing you on the course.