June 2023 SBA 504 Interest Rates

The June 2023 SBA 504 debenture pricing was competed on June 8, 2023.

25 Year Term 6.33%

20 Year Term 6.38%

The SBA offers a 504 Loan with a 25-year maturity for the acquisition of owner-occupied commercial real estate and related costs. This is in addition to the 10 and 20 year loans currently available in the 504 Loan Program. Loans are typically eligible for up to 90% financing of project costs. Rates include monthly servicing fees to CDC, SBA, and central servicing agent; based on SBA FY23 fees. SBA 504 refi rates are approximately 2 basis points higher than debenture pricing noted above.

This spring the U.S. Small Business Administration published two new rules impacting the SBA 504 program. The National Association of Development Companies (NADCO) and the certified development company (CDC) lending industry have long advocated for regulatory changes to make the 504 loan process more efficient and get capital into the hands of small business owners faster, while maintaining the integrity of the program. Click here to learn more about these program changes and stay tuned for implementation updates.

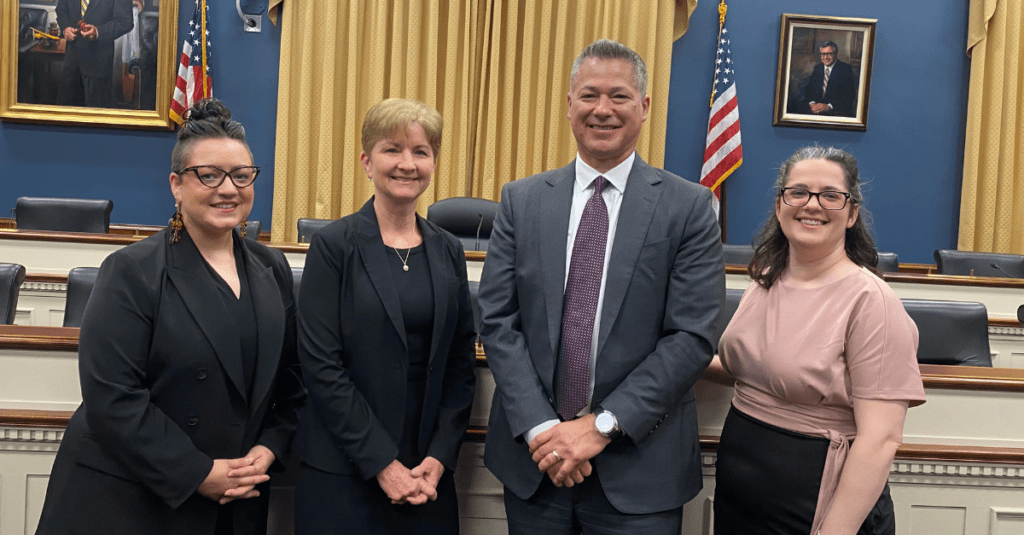

Manuel Flores, the President & CEO of SomerCor, testified before the U.S. House of Representatives Small Business Committee on May 17, 2023, representing NADCO and the CDC lending industry.

The purpose of the hearing was to provide Members of Congress with a lender perspective on substantial program changes recently issued by the Small Business Administration. Click here to watch the full hearing and read submitted testimony.