January 2022 SBA 504 Interest Rates Are Out

25 Year Term 3.21%

20 Year Term 3.07%

10 Year Term 3.07%

Earlier this year the Small Business Administration published Interim Final Rule 021-15975, outlining enhancements to the SBA 504 refinance program. Get up to speed on changes made to the 504 refi and how it can support your small business clients as a strategic debt restructuring solution. Use the link below to access the slides and view a recording of SomerCor’s webinar on the program changes.

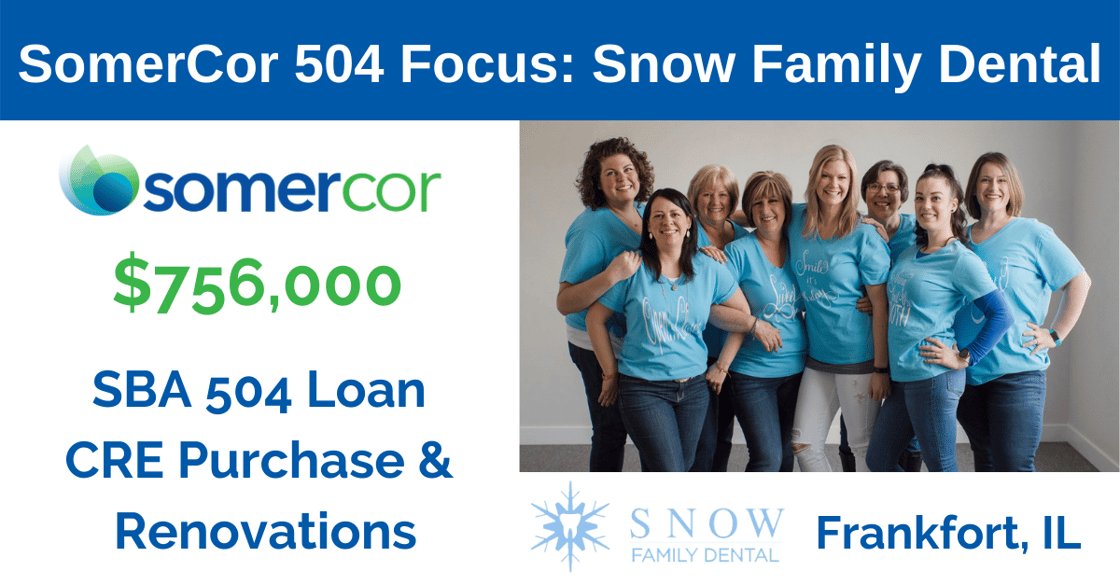

“The long-term fixed low interest rate afforded me the opportunity to build my dream office,” said Dr. Snow. “SomerCor helped me access critical capital, despite my limited equity and business history. Without the 504 loan, I would never have been able to build the practice into what it has become today. Overall my experience has been nothing but positive and I am forever grateful this type of funding exists.“