Certified Development Companies Provide Critical SBA Program Expertise to Lenders

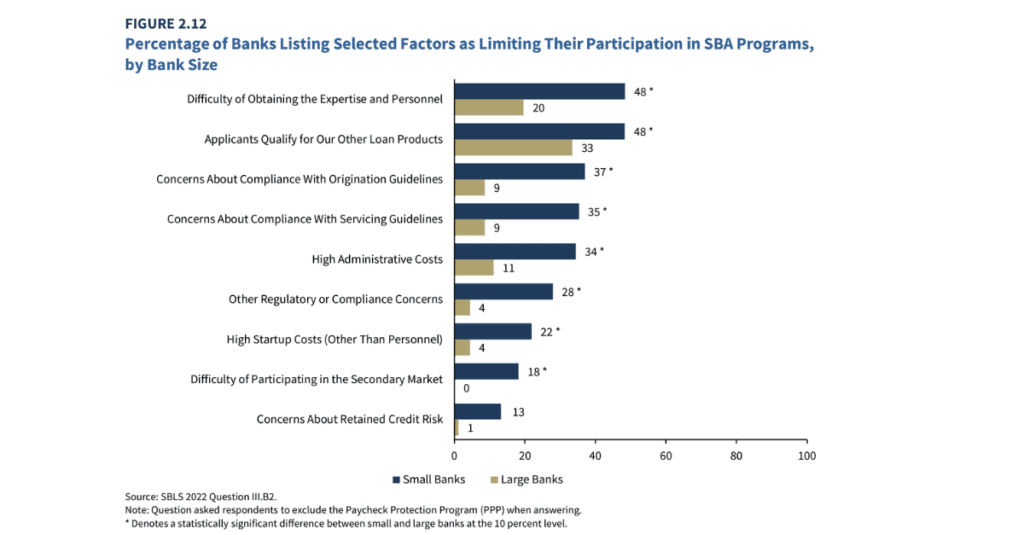

According to the 2024 Federal Deposit Insurance Corporation (FDIC) Small Business Lending Survey, lack of expertise and qualified personnel is a top reason why lenders limit their Small Business Administration (SBA) program lending.

For smaller banks – less than $10 billion in assets – the lack of expertise is coupled with concerns about compliance. The survey showed that fewer than half of small banks participate in government-guarantee loan programs that target small business borrowers, while most large banks do to some extent.

Certified Development Companies (CDCs), like SomerCor, exist to help close the information gap for all lenders and expand access to capital for businesses through the SBA 504 loan program.

The SBA 504 program offers lenders a secure lending option to help business owners buy, expand or refinance fixed assets. The unique structure of the 504 operates as a public-private partnership with a CDC, in which the lender takes first lien position on the assets being financed. Generally, the lender finances 50% of the project, the CDC provides up to 40%, and the borrower contributes at least 10% of the financing.

CDCs are certified by the SBA as non-profit corporations charged with promoting economic development through SBA 504 loan program. CDCs manage the SBA 504 loan application, underwriting, funding, and servicing over the life of the loan. The SomerCor staff has a high level of expertise, and serve with the dual purpose of helping business owners access the 504 loan and partnering with participating lenders to navigate the SBA lending process quickly and efficiently.

Far from a financing tool of last resort, in a sense, a lender is able to outsource the entire SBA loan process to the CDC while making a conventional senior mortgage loan at a 50% LTV. The 504 program enables lenders to participate in strong small and mid-size business loans, diversify loan portfolios, mitigate lending risk, expand their credit box, and earn Community Reinvestment Act credit.

The SomerCor team is here to help. Download the program flyer, call or email us today to learn how SomerCor can support your institution’s SBA lending portfolio. Our loan officers are available to provide informational presentations and details on the latest SBA 504 program updates.