April 2023 SBA 504 Interest Rates

The April 2023 SBA 504 debenture pricing was competed on April 6, 2023.

25 Year Term 5.88%

20 Year Term 5.95%

The SBA offers a 504 Loan with a 25-year maturity for the acquisition of owner-occupied commercial real estate and related costs. This is in addition to the 10 and 20 year loans currently available in the 504 Loan Program. Loans are typically eligible for up to 90% financing of project costs. Rates include monthly servicing fees to CDC, SBA, and central servicing agent; based on SBA FY23 fees. SBA 504 refi rates are approximately 2 basis points higher than debenture pricing noted above.

Update from the SBA 504 Central Servicing Office

for Future Loan Payments

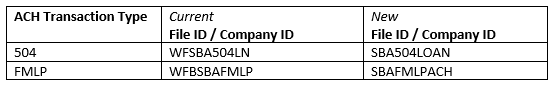

Effective April 14, 2023, the CSA will be updating both the File ID and Company ID associated with ACH transactions for 504 and FMLP loan payments per the chart below. The File ID and Company ID are 10-digit unique identifiers used to identify the entity who is collecting a payment via ACH.

ACH ID Changes:

Recommended Actions for Borrowers:

No changes will need to be made to the borrower’s ACH account.

If the Borrower’s financial institution has a fraud filter based on a Company ID or File ID in the ACH file, that filter should be updated to accept the new IDs referenced above and prevent the loan payment from being returned.

The CSA and SomerCor are unable to confirm which financial institutions utilize a fraud filter and could potentially be affected; thus, Borrowers should contact their financial institution with any concerns before the May 1, 2023 loan payment is debited from their financial institution’s account.

If you have any questions, please contact our servicing team: David Sommers, EVP, Loan Servicing Director dsommers@somercor.com or at (312) 360-3322

The SBA 504 program offers banks a secure lending option to help small business clients buy, expand or refinance fixed assets, while at the same time reducing their own credit exposure. Learn more about how the 504 lowers lending risk, increases liquidity, strengthens existing loan portfolios, and expands potential lending opportunities for banks.