The April 2022 SBA 504 debenture pricing was completed on April 7, 2022.

25 Year Term 4.68%

20 Year Term 4.62%

The SBA is offering a 504 Loan with a 25-year maturity for the acquisition of owner-occupied commercial real estate and related costs. This is in addition to the 10 and 20 year loans currently available in the 504 Loan Program. Loans are typically eligible for up to 90% financing of project costs. Rates include monthly servicing fees to CDC, SBA, and central servicing agent; based on SBA FY22 fees. SBA 504 refi rates are approximately 1 basis point higher than debenture pricing noted above.

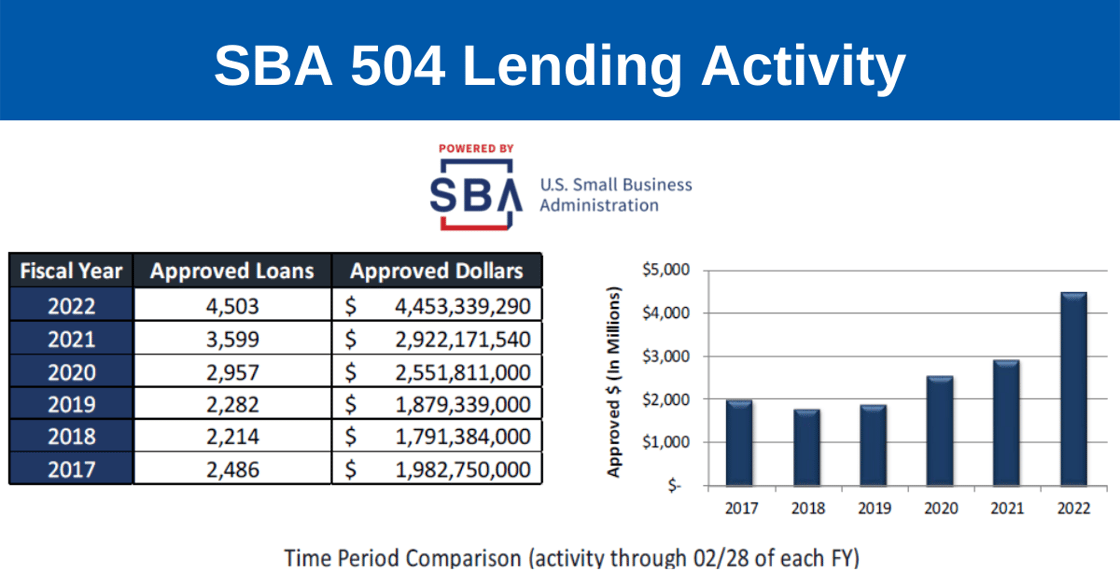

Since the start of the pandemic the SBA 504 program has seen unprecedented demand, leading to the largest annual loan volume in the history of the program at $8.2 billion in FY21. Loan activity over the first five months of FY22 shows how popular this program continues to be for small businesses looking to finance fixed assets.

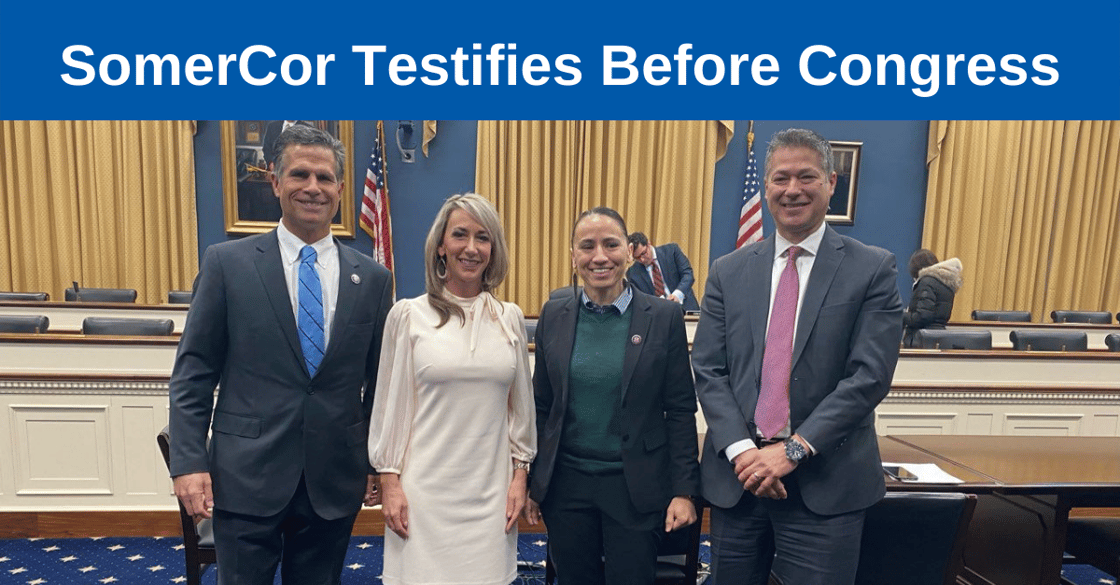

On Tuesday, March 29th, SomerCor President & CEO, Manuel Flores, testified at a House Small Business Committee hearing titled “Catalyzing Economic Growth through SBA Community-Based Lending. It was a great opportunity to share with legislators the integral role CDCs play in bringing economic development resources to communities across the nation, especially through the deployment of the SBA 504 program