November 2024 SBA 504 Interest Rates

25 Year Term 6.28%

20 Year Term 6.35%

10 Year Term 6.46%

The November 2024 SBA 504 debenture pricing was completed on November 7, 2024. The SBA offers a 504 Loan with a 25-year maturity for the acquisition of owner-occupied commercial real estate and related costs. This is in addition to the 10 and 20 year loans currently available in the 504 Loan Program. Loans are typically eligible for up to 90% financing of project costs. Rates include monthly servicing fees to CDC, SBA, and central servicing agent; based on SBA FY25 fees. SBA 504 refi rates are approximately 3 basis points higher than debenture pricing noted above.

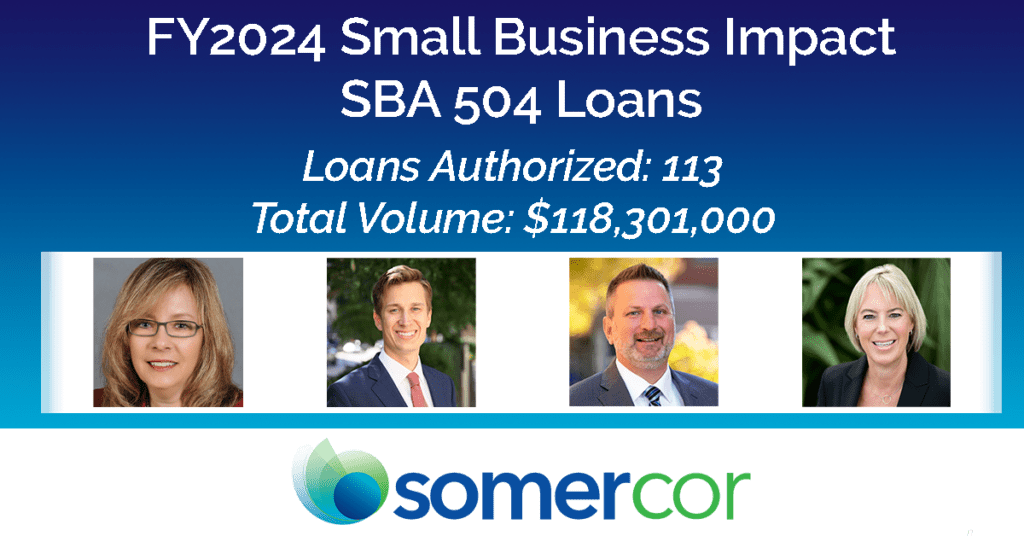

Congratulations to the SomerCor loan origination team on a banner year! In FY24, 113 SBA 504 loans were authorized totaling $118,301,000 for SomerCor clients. These loans financed fixed assets for small and mid-size businesses across Illinois, northwest Indiana, and southeast Wisconsin. This critical capital helped entrepreneurs create jobs, improve cash flow, optimize operations, maximize production, and build equity. Excited to see the team’s impact in FY25!

The SBA 504 refinance program helps small and mid-size businesses take advantage of lower interest rates and access equity for working capital.

Effective November 15, 2024, the Small Business Administration (SBA) improves the SBA 504 Refinance program to streamline the loan process and expand borrower eligibility (Direct Final Rule 89 FR 79734).

Think you or your business client could be a good fit for the SBA 504 Refi? Check out a breakdown of the upcoming rule changes here, and contact a member of the SomerCor team today!