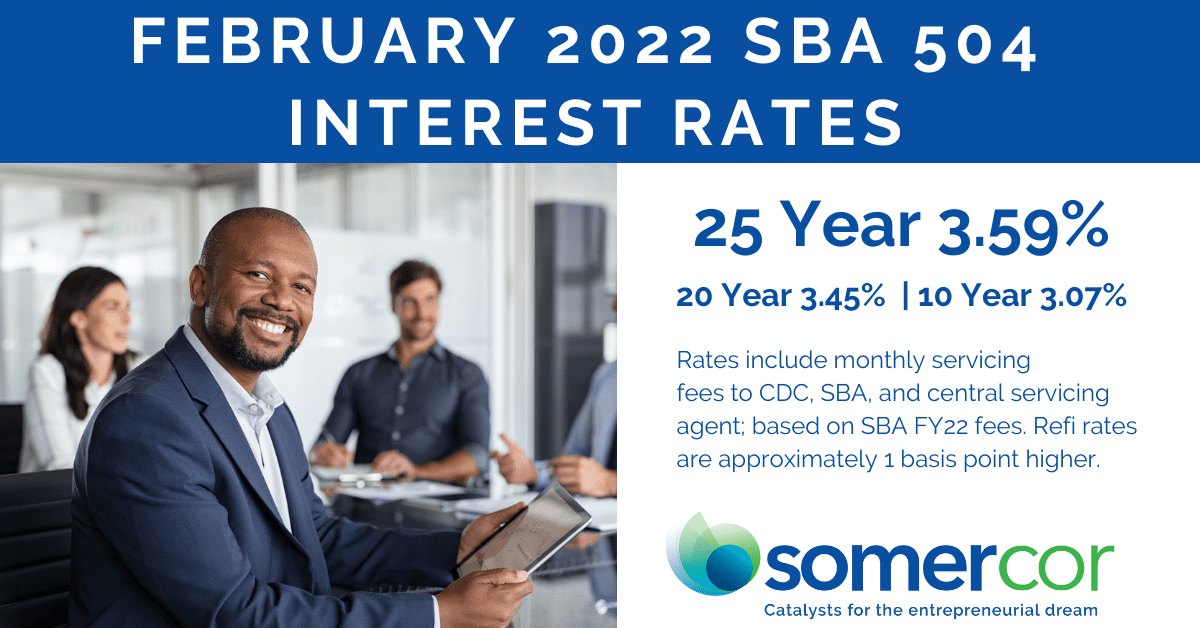

February 2022 SBA 504 Interest Rates Are Out

25 Year Term 3.59%

20 Year Term 3.45%

10 Year Term 3.07%

The SBA is offering a 504 Loan with a 25-year maturity for the acquisition of owner-occupied commercial real estate and related costs. This is in addition to the 10 and 20 year loans currently available in the 504 Loan Program. Loans are typically eligible for up to 90% financing of project costs. Rates include monthly servicing fees to CDC, SBA, and central servicing agent; based on SBA FY22 fees. SBA 504 refi rates are approximately 1 basis point higher than debenture pricing noted above.

| SomerCor is a proud member of the Illinois Bankers Association. At their upcoming ONE Conference SomerCor President & CEO, Manny Flores, will lead an education session titled “Rethinking Community Investment Through Access to Capital.” Click the button below to learn more and register to attend in person or virtually on March 3-4th in East Peoria. |

SomerCor partnered up with Municipal Market on an SBA 504 refinance of the property. The original loan used to finance the market had a a five year term and was set to balloon at the end of 2023. By using the 504 refi, their debt was restructured and the SBA portion is now under a 25 year term. Plus, the lower interest decreased monthly mortgage payments on the property by 25%.