SomerCor’s Top 10 SBA 504 Program FAQs

What is the SBA 504 program?

The SBA 504 loan program is the premier economic development loan program administered by the Small Business Administration (SBA). This public-private partnership provides a long-term fixed rate lending solution for small business owners to buy, expand or refinance major fixed assets – such as land, commercial real estate, equipment, and machinery. The program name comes from Section 504 of the Small Business Investment Act of 1958.

What are the goals of the SBA 504 program?

The 504 program is one of the SBA’s loan guaranty programs. The main goal is to encourage traditional lenders to provide loans to small businesses in need of capital. Borrowers also must meet specific benchmarks related to:

- Job creation/retention

- Community development (i.e. improving, diversifying, or stabilizing the economy of the locality)

- Public policy (i.e. expanding the development of women, minority or veteran-owned businesses; or modernizing or upgrading facilities to meet health, safety, and environmental requirements)

- Energy reduction (i.e. upgrading facility, equipment, and processes involving renewable energy source)

Who participates in the SBA 504 program?

The SBA 504 program requires three key players – a small business borrower, a Certified Development Company (CDC), and a third party lender (i.e. bank or credit union). CDCs, like SomerCor, are nonprofit corporations, certified and regulated by the SBA, to originate and service SBA 504 loans.

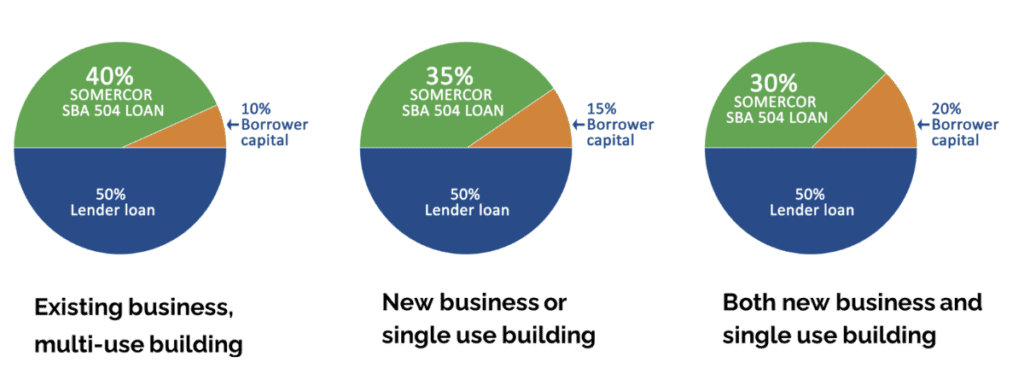

Typically, the final loan structure requires the third party lender provide 50% of the financing, the CDC provides up to 40% of the financing backed by a 100% SBA-guaranteed debenture, and the applicant provides at least 10% of the financing.

What are the benefits of the SBA 504 program?

Benefits to the small business borrower:

- Lower down payments, up to 90% financing for established businesses

- Below-market interest rates for lower and more affordable monthly mortgage payments

- Long term rates 10, 20 or 25 year fixed with no surprise balloon payments

- Frees up working capital – leaving more money to reinvest in the business

As the SBA guarantees the CDC portion of the loan and the lender is in first lien position at a 50% Loan To Value (LTV), benefits to the third party lender include:

- lower lending risk

- expanded credit box

- diversified loan portfolios

- increased liquidity

- SBA 504 loans qualify for Community Reinvestment Act credit

What type of business can borrow through the SBA 504 program?

To apply for the 504 loan an applicant must:

- For-profit business, located in the United States

- Have a tangible net worth less than $20 million

- Average net income, after federal income taxes, of less than $6.5 million for the preceding two years (note – industry parameters may apply)

The 504 is industry agnostic – manufacturing, health care, professional services, restaurants, hospitality, retail, day cares, breweries – all these industries and more can utilize the 504 program.

What business and personal financial factors determine loan approval?

The goal of the SBA and SomerCor is to help small businesses access capital. Overall, the loan must be sound as to reasonably assure repayment. The SBA will consider:

- borrower character, reputation, and credit history

- experience and depth of management

- market demand for the borrower’s product or service

- past earnings, projected cash flow, and future prospects

- ability to repay the loan with earnings from the business

- sufficient invested equity to operate on a sound financial basis

- potential for long-term success

- nature and value of collateral (although inadequate collateral will not be the sole reason for denial of a loan request)

How is the SBA 504 program funded?

The SBA 504 is a zero-subsidy program, meaning that it does not require additional federal funding every year to operate.

Instead, the 504 program is funded through the sale of CDC debentures, fully guaranteed by the SBA, to private investors. The federal government acts as a guarantor only. Program fees charged to participating lenders and borrowers offset expenses associated with the guaranty.

What can SBA 504 loan funds be used for?

The 504 program requires the proceeds support owner-occupied commercial real estate (at least 51% applicant occupancy for existing or 60% for new construction). Allowable use of funds includes:

- Acquire land

- Purchase one or more existing buildings

- Convert, expand or renovate one or more existing buildings

- Acquire and install machinery and equipment having a useful life of ten years or more. These assets must be at a fixed location

- Construction of real estate

- Refinance mortgage debt, including certain existing SBA 7(a) and 504 loans, through the 504 Refi program

- Cover certain soft costs and professional fees

Loan proceeds cannot be used for working capital, inventory, goodwill, business stock, vehicles, franchise fees, or legal fees.

How do I apply for an SBA 504 loan or 504 Refi? What documents should I have prepared to submit as part of my SBA 504 application?

Small businesses should start by talking to their commercial banker about financing options and to discuss partnering with SomerCor on a 504 loan. Business owners can also reach out directly to the SomerCor team for more information and to be connected with a lender.

Key items borrowers should have prepared include:

- Last three years corporate tax returns for business & personal federal income tax returns

- Last three years corporate tax returns for all affiliates (if any)

- Interim financial statements (within 90 days)

- Schedule of existing company debt (creditor, balance, monthly payment)

- Most recent aging of accounts receivable and payable

- Two-year income and expense projections

- Borrower’s personal financial statement (bank form is acceptable)

Whether a borrower applied through their lender or reached out to SomerCor directly, our experienced loan origination team is available as a resource throughout the application process.

After applying for the SBA 504 program, what is the approval and funding process?

Step 1:

The complete borrower application it is sent to the SBA for review. Once approved, the SBA will issue a Terms and Conditions document outlining the their approval. The CDC and applicant sign the Terms and Conditions and it is returned to the SBA.

Step 2:

The project now shifts into the closing process. SBA 504 loans are not closed until after project-related construction is complete. Prior to the sale of a debenture and the SBA’s funding of the CDC portion of the loan, the borrower may obtain interim financing from a third-party lender, usually the same lender that provided the loan covering 50% of the total project financing. The proceeds from the future debenture sale will repay the interim lender for the amount of the project costs that it advanced.

Step 3:

The borrower and third party lender receive a checklist of items to return to the CDC to complete the closing process. The lender closes its permanent and interim loans which result in the borrower acquiring title to the project assets.

Step 4:

Upon project completion, once the CDC receives all the items on the closing checklist, the SBA’s district counsel reviews the closing package and notifies the Central Servicing Agent and the CDC to confirm that the loan meets closing requirements and is approved for debenture funding. Once the loan is priced and funded (debenture sales happen on a monthly basis), the loan proceeds are wire transferred to the participating third party lender to pay down its interim loan.

Step 5:

Moving forward, the borrower makes two loan payments, one to the third-party lender and another to the CDC. The third-party loan, typically provided by a bank, can have a fixed or variable interest rate, is negotiated between the lender and the borrower, is subject to an interest rate cap, and must have at least a 7-year term for a 10-year debenture and at least 10-year term for a 20- or 25-year debenture. The CDC loan has a fixed interest rate that is determined when the SBA sells the debenture to fund the loan. The CDC loan term is either 10 years (typically for machinery or equipment) or 20 years or 25 years (typically for real estate).

Download the program flyer and contact our team today for more information on the SBA 504 loan program.